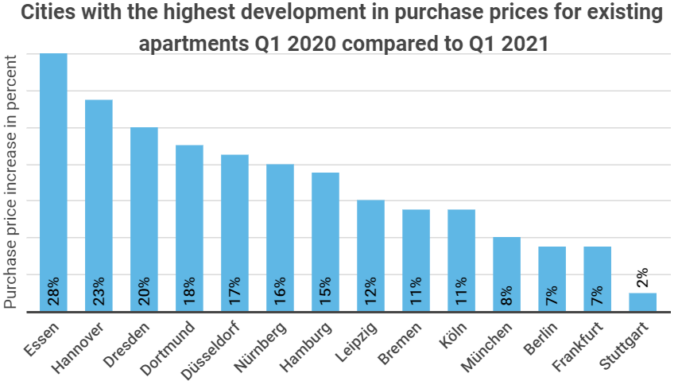

The Corona crisis aside, real estate in Germany is becoming more and more expensive. The price of existing flats in Essen rose by 28% between the first quarter of 2020 and the first quarter of 2021. Newly built flats have also become considerably more expensive. This is shown in a new infographic from Block-Builders.de. While the average citizen is convinced that property prices are overinflated, academics expect prices to continue to rise.

Hanover comes second in a ranking of price gains for existing flats in the past year, with prices here rising by 23%. This is followed by Dresden (20%), Dortmund (18%) and Düsseldorf (17%).

Meanwhile, 37.8% of German citizens believe that property prices are significantly overvalued. 25.7% consider them to be rather overvalued, and only a negligible 2.1% consider current prices to be significantly undervalued. The Bundesbank also sees signs of overvaluation, but is not warning of a bubble. Academics provide a contrasting view.

Real Estate Boom

The University of Freiburg expects property prices in Germany to rise until 2060. This especially applies to metropolitan areas and sought-after locations, above all in the south of Germany. The reasons behind this are international migration, the trend towards smaller households, a low supply of real estate and the increase in living space per person. As the infographic shows, the average citizen lives in an area of 45m² – in 2030, the average is expected to rise to 49m².

As can be seen in the Block-Builders data, holiday homes are also becoming increasingly popular. More and more citizens are searching for such a property via Google; the Google Trend Score, which indicates the relative search volume, currently stands at 81. A closer look shows that there are also certain outliers: the relative search volume for “buy holiday home Italy” climbed by 600%. Holiday properties on Rügen (search volume increase of 300%) and Bavaria (search volume increase of 190%) are also very popular.

One Man’s Joy, Another Man’s Sorrow

Property owners should be thrilled by this development. However, shareholders in real estate companies have not benefited as much from the recent price increases. Despite the rally, Vonovia’s stock market value rose by just 7.6% in a 12-month review, while the DAX gained 42.3%. A similar picture emerges for Deutsche Wohnen. Vonovia shareholders also fared worse over the course of the month, losing 9.6%.

Leave a Reply