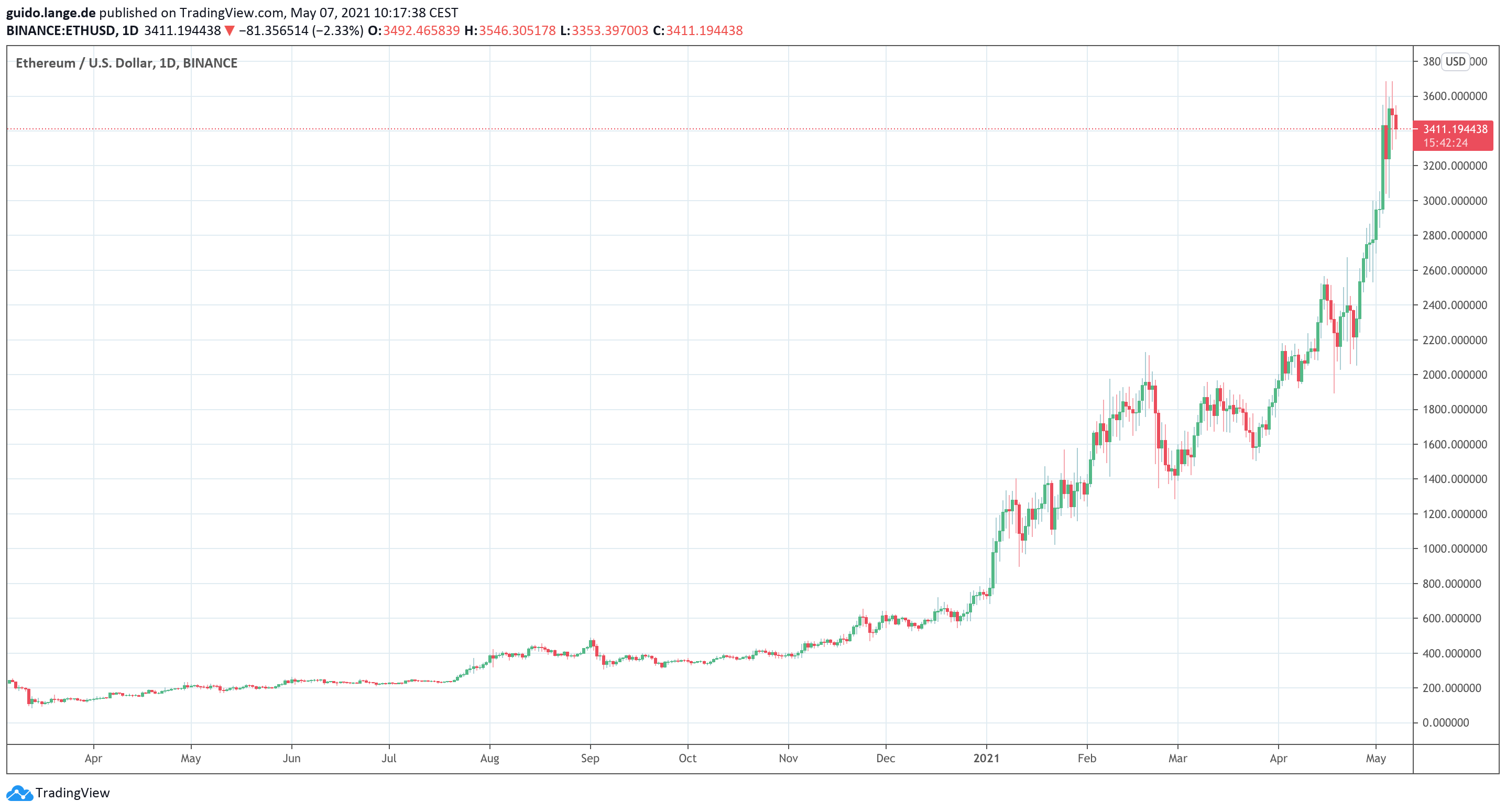

Ethereum (ETH) is currently trading at record levels. Risk-tolerant traders are currently already betting on a further doubling of the price of Ether from the end of June. What’s behind it?

At times almost 3,600 U.S. dollars, Ethereum(ETH) has recorded a new all-time high on Friday night and has meanwhile gained more than 400 percent since the beginning of the year. Market data shows that some traders firmly believe that the recent development in Ether is only the beginning of a bull cycle. That’s because options trades are piling up on Ethereum, which see ETH reaching levels of $8,000 and above by the end of June at the latest. What makes investors make such risky bets?

This is why the price of Ethereum could explode

In the analysis, two weighty arguments crystallize in favor of further pumps in Ethereum:

- Ethereum did not catch up to its previous all-time high of 2018 until early 2021. This meant that the world’s second most important cryptocurrency, not only in terms of market capitalization, was weeks later than Bitcoin (BTC), which started the upward trend as a reserve currency in December 2020. Since then, Bitcoin has held up extremely well in previously unseen price territory. Ethereum still has some catching up to do in these regions.

- DeFi (Decentralized Finances) remain the theme of the year for the crypto industry and here Ethereum is the linchpin. But high transaction fees for ETH are hindering the next phase of growth for DeFi. EIP-1559 aims to remedy the situation. Behind the cryptic acronym is a downright revolutionary proposed improvement for Ethereum’s system. Instead of paying out transaction fees (gas fees) to miners and determining their prices through real-time auctions, EIP-1559 would provide fixed transaction fees – and these would not go to miners, but would automatically be used to buy back ETH from the free market and destroy it (burne). It is hoped that this trick will increase the price of ETH while at the same time addressing the issue of high transaction fees. A launch of EIP-1559 would probably be technologically possible by the end of June.

Ethereum – where does the path lead?

Now, as an investor, you should also include two other important facts about the forecasts for Ethereum in your strategy:

- EIP-1559 is by no means a done deal, miners fear income losses. Whether they end up agreeing to the reform – as required for EIP-1559 – is currently being explored. EIP-1559 would hardly be able to be pushed through against the computing capacities of large mining pools for ETH.

- The observed option trades in ETH, betting on prices of $8,000 and above, are often organized in the form of out-of-the-money (OTM). With this instrument, at the maturity date, the trader risks taking the difference from the then-current price as a loss if the price target is not reached. Skeptics therefore also compare Out-of-the-Money with a lottery.

Conclusion: Optimism with ETH

A more recent forecast for Ethereum sees ETH at $10,000 by the end of the year and also takes the overall market for cryptocurrencies into account as a driving moment. At a glance, it can at least be stated: A growing number of professionals are convinced that the current all-time highs of ETH still leave a lot of room for the price to rise, with EIP-1559 as the critical indicator for whether Ethereum’s followers can agree on reforms.

Best place to buy Bitcoin and Ethereum:

Leave a Reply